- Commercial Real Estate Weekly

- Posts

- Investors Wait Out Policy and Inflation Jitters 🌉

Investors Wait Out Policy and Inflation Jitters 🌉

Big Bets Pause as Market Signals Stay Mixed

Find customers on Roku this holiday season

Now through the end of the year is prime streaming time on Roku, with viewers spending 3.5 hours each day streaming content and shopping online. Roku Ads Manager simplifies campaign setup, lets you segment audiences, and provides real-time reporting. And, you can test creative variants and run shoppable ads to drive purchases directly on-screen.

Bonus: we’re gifting you $5K in ad credits when you spend your first $5K on Roku Ads Manager. Just sign up and use code GET5K. Terms apply.

Hey there,

Short bridge renewals keep tenants in place when long commitments feel risky. A 12- to 24-month extension with light flexibility buys clarity without vacancy.

Which near-term expiry on your roll could stabilize fastest with a bridge instead of a hard push for a full term?

Table of Contents

Renewal Strategy Play

Bridge Renewal with Upside Options

When a tenant is 3–9 months from expiry and unsure about long-term plans, use a short bridge renewal instead of forcing a full 5–7-year decision. The core idea: offer a 12- to 24-month extension with built-in flexibility (expansion, contraction, or termination options), so you avoid vacancy while the tenant gains time and clarity.

3 quick steps:

Target uncertain tenants: From your rent roll, flag tenants close to expiry who are stalling on renewal because of business uncertainty, consolidation, or market noise.

Structure the bridge: Propose a 12- to 24-month extension at slightly above current rent with fixed annual bumps, plus clearly defined options (early termination fee, defined giveback, or expansion right) instead of heavy TI.

Document and plan: Lock in the bridge on a short amendment, update your rollover forecast, and pre-plan backfill or long-term renewal discussions 6–9 months before the bridge ends

Expected result:

Fewer surprise move-outs at expiry, steadier short-term NOI, and a smoother path to either a full renewal or a planned backfill instead of last-minute, high-stress leasing.

🏗️ Silicon Valley Pipeline Craters 79% as Leasing Hits 7-Year High

Developers in Silicon Valley cut projects underway to 4.5 million square feet, the lowest since 2013. That is down 45% from late 2024 and 79% from the 2021 peak. Leasing hit 20.4 million square feet through Q3, pacing the best year since 2018. High vacancies and uncertainty stalled starts, even as completions spiked. See full article.

Why this matters (fast take):

📉 Pipeline Nears Floor: Under development sank to 4.5M sq ft, the lowest since 2013, and down sharply from both 2021 and late 2024, even as new projects finish.

📈 Leasing High, Caution Remains: 20.4M sq ft leased through Q3 puts 2025 on track for the strongest demand since 2018, but vacancy around 22% keeps developers wary of new starts.

🧩 81% Want New Tech, Yet Spreadsheets Still Run CRE Ops

Property owners say tech matters, but teams still run portfolios on creaky spreadsheets. Early adopters process three times the portfolio with the same headcount and cut manual work by up to 80%. The unlock is automation plus cleaner alerts, pushed by a generational handoff that wants mobile access and real-time data. See full article:

Fast move:

📊 Tech Intent, Legacy Reality: 81% of organizations say technology is a priority, yet many still manage multimillion-dollar portfolios in brittle spreadsheets, prompting families to modernize before tribal knowledge walks out the door.

🚀 Automation Powers Scale: Automated workflows flip the work mix, cutting up to 80% of manual tasks so lean teams can manage portfolios three times larger while refocusing on leases, renewals, and tenant relationships.

📊 Phoenix Broker Confidence Hits 62.7 as Capital Markets Thaw

Phoenix brokers turned upbeat. ASU’s new Commercial Broker Sentiment Index scored 62.7, the highest since rate hikes began, pointing to better leasing and sales over the next six months. The unlock is cheaper money and tighter spreads, which favor premium Class A offices and long-starved retail. That momentum could pull more investors off the sidelines into 2026. See full article.

Fast move:

📈 Confidence Rebounds: CBSI hit 62.7, up from the 30s in 2022, signaling moderate optimism for leasing, sales, and investment over the next 12–24 months.

💵 Capital Favors Quality: Easing rates and tighter spreads are drawing investors back, with momentum strongest for premium Class A offices and underbuilt neighborhood retail in fast-growing submarkets.

Property Management Upgrade Move

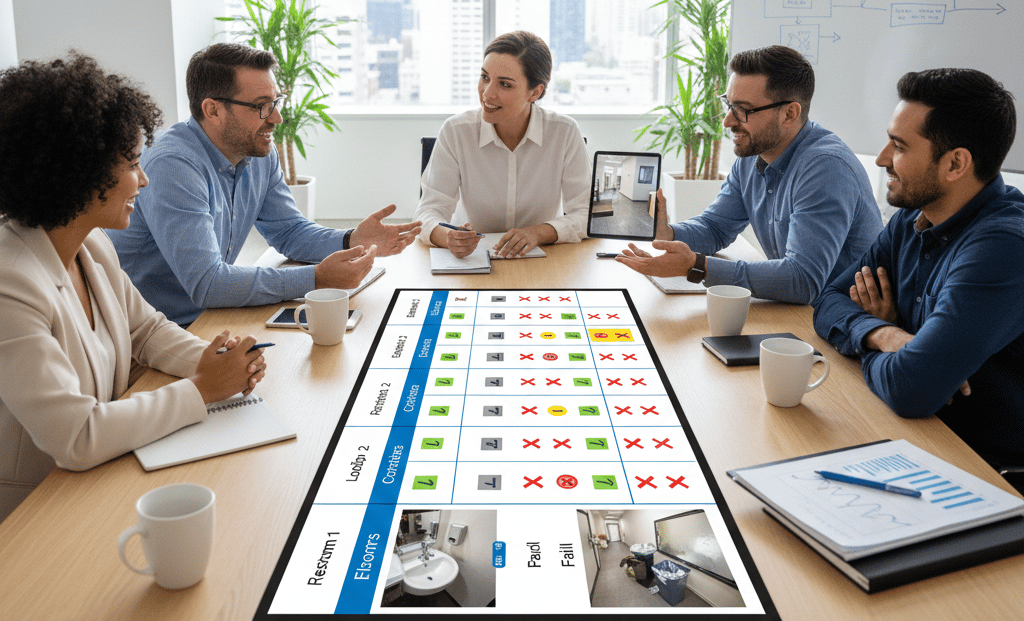

Cleaning Quality Scorecard & Photo QA

Cleaning is one of the top drivers of tenant perception, yet most assets rely on informal complaints and generic janitorial contracts. Without a simple scorecard and basic photo QA, you get uneven results between floors, recurring misses in restrooms and lobbies, and “it looks tired” feedback that hurts renewals.

3 Steps to Roll This Out:

Define standards and hotspots: Create a short cleaning spec by area type (restrooms, lobby, corridors, elevators, loading dock) with 3–5 key checks per area, plus photo examples of “pass” vs “fail.”

Implement monthly scorecards: Once a month, have PM or building staff walk each floor with the scorecard, capture quick photos of hotspots, and log scores in a shared tracker by area and vendor.

Close the loop with vendors and tenants: Review results with cleaning vendors, tie scores to small incentives or warnings, and share periodic “before and after” improvements with tenants.

Expected result:

Within 1–2 quarters, you will see fewer cleaning complaints, more consistent building presentation, and a clearer link between janitorial spend and visible quality across the portfolio.

📊 Take This Edition’s Poll:

|  |

Why It Matters

Bridge renewals protect short-term NOI and reduce surprise move-outs while tenants sort out plans. Start by flagging uncertain tenants, drafting a simple 12- to 24-month option set, and updating your rollover model.

Make sure expansion, giveback, and termination terms are documented cleanly to avoid future disputes.

Catch you in the next issue,

Anne Morgan

Editor-in-Chief

Commercial Real Estate Weekly

P.S. Interested in sponsoring a future issue? Just reply to this email and I’ll send packages!

How was today's edition?Rate this newsletter. |