- Commercial Real Estate Weekly

- Posts

- Value-Add Plan Targets Fitness, Lobby, Commons 🛠️

Value-Add Plan Targets Fitness, Lobby, Commons 🛠️

Big Tenants Anchor 1 N Dale Mabry in Tampa

Learn how to make every AI investment count.

Successful AI transformation starts with deeply understanding your organization’s most critical use cases. We recommend this practical guide from You.com that walks through a proven framework to identify, prioritize, and document high-value AI opportunities.

In this AI Use Case Discovery Guide, you’ll learn how to:

Map internal workflows and customer journeys to pinpoint where AI can drive measurable ROI

Ask the right questions when it comes to AI use cases

Align cross-functional teams and stakeholders for a unified, scalable approach

Hey there,

What happens when an office tower changes hands at a discount, then gets a fresh round of upgrades right away?

In Tampa’s Westshore, a 13-story, 260,000-square-foot building traded in a $40M short sale, with plans for $4M in improvements like a coffee bar, terrace work, and updated common areas.

Take a moment to see what this deal says about where office pricing and repositioning are headed.

Table of Contents

Renewal Strategy Play

Click-to-Sign Renewal Pack

When a tenant is 3 to 9 months from expiry and basically happy, use a pre-built, e-sign renewal pack instead of restarting a full negotiation. The core idea: send a short, pre-approved amendment with simple economics and a modest refresh so renewals become a fast, low-friction workflow rather than a one-off project.

3 quick steps:

Template the deal: Create a standard 2 to 3 page renewal amendment with pre-approved term lengths, escalations, and a light refresh allowance that works for most tenants in that asset.

Pre-fill and send: At 3 to 9 months out, drop in tenant specifics (rent, term, dates, minor tweaks), attach a one-page summary, and send via e-sign with a short email framing it as your simple, no-drama renewal path.

Track and follow up: Use a simple tracker to monitor opens and signatures, follow up with a call only where needed, then immediately update WALT, lender packages, and internal dashboards once signed.

Expected result:

Higher and earlier renewal capture, less time lost in legal and back-and-forth, and a repeatable renewal machine your team can run with minimal effort across office, retail, and industrial assets.

🏗️ $40M 260,000 SF 1 North Dale Mabry Trades in Tampa Short Sale

A JV led by Enverra Real Estate Partners acquired 1 North Dale Mabry, a 13-story, 260,000 SF office tower in Tampa’s Westshore submarket. The report cites a $40M short sale about five years after the prior owner bought it for $56.5M, and the new owner plans $4M in upgrades, including a coffee bar, terrace improvements, and common-area updates. See full article.

Why this matters (fast take):

📍Site & Scale: Westshore location and 260,000 SF size, with a defined amenity and common-area upgrade plan.

📈Timeline & Market: The $56.5M to $40M reset plus $4M capex is a clean signal of office price discovery and near-term repositioning.

🏗️ $57M Refi Secured for 422,337 SF Brook Highland Plaza

CBRE arranged a $57M refinancing for Brook Highland Plaza, a 422,337 SF power center on 52 acres along U.S. Highway 280 in Birmingham. The asset was 94.4% leased, with tenants including Sprouts Farmers Market, Best Buy, and Burlington, and the borrower was First National Realty Partners. See full article.

Fast take:

📍Site & Scale: 422,337 SF on 52 acres in a major retail corridor, with large-format tenancy.

📈 Timeline & Market: A sizable $57M refi on 94.4% leased space shows lenders will still back well-leased power retail.

🏗️ $15.6M C-PACE Backs 103,000 SF The Lumin Office Project

Bayview PACE provided $15.6M in C-PACE financing for The Lumin, a 103,000 SF speculative office project under construction in Bryan. The building sits within the 350-acre Lake Walk master-planned development and includes ground-floor retail and an on-site parking garage, with completion expected in spring 2027, and William Cole Cos. as borrower. See full article.

Fast take:

📍 Site & Scale: 103,000 SF inside a 350-acre master plan, with retail and parking integrated into the program.

📈 Timeline & Market: A defined delivery target, spring 2027, plus C-PACE capital, shows how sponsors are structuring office builds today.

Property Management Upgrade Move

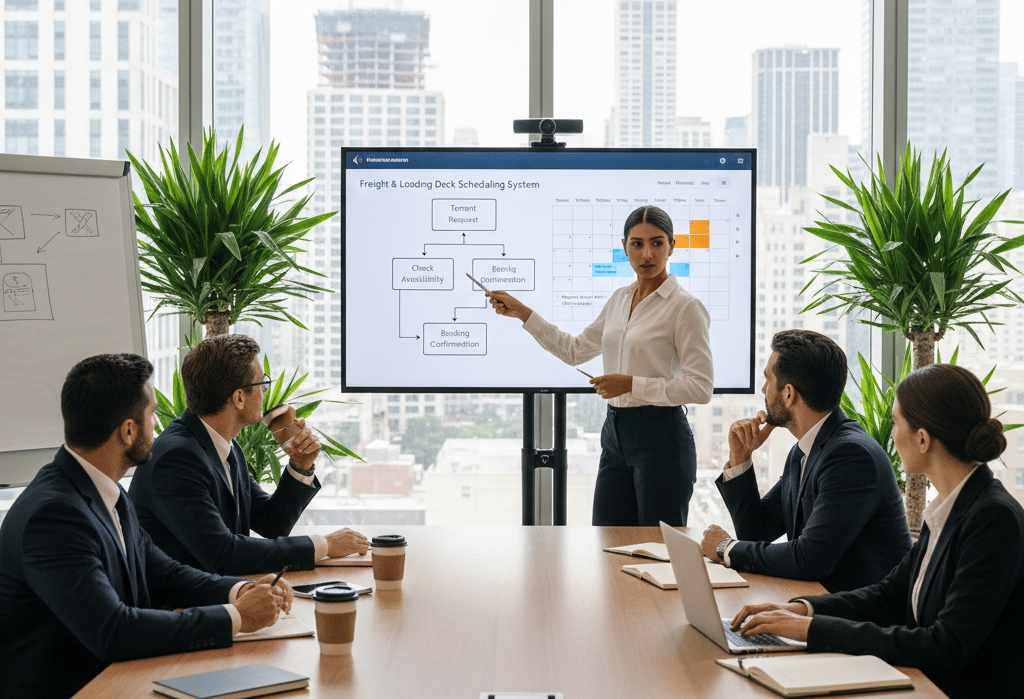

Freight & Loading Dock Scheduling System

In many multi-tenant buildings, freight elevators and loading docks are run on a first-come, first-served basis. That leads to double-booked moves, angry tenants, and security teams improvising schedules at the worst possible times. A simple scheduling system brings order and predictability in 1–2 quarters.

3 Steps to Roll This Out:

Map current demand and rules: Review the last 60–90 days of moves and deliveries, note peak days and hours, and write a one-page rule set (booking windows, maximum durations, blackout times, overtime requirements).

Stand up a booking tool: Use a basic online calendar or portal where tenants (or their movers) must reserve freight and dock slots, with auto-confirmations and clear instructions.

Train and enforce at the dock: Train security and building staff to verify bookings at check-in, log arrivals and overruns, and redirect unscheduled users to open slots only.

Expected result:

Within 1–2 quarters, you should see fewer dock and freight complaints, more predictable move and delivery days, and measurable reductions in overtime and operational disruption.

📊 Take This Edition’s Poll:

|  |

Why It Matters

This kind of price reset is a real snapshot of value discovery in the office, not just talk on a slide. The upgrade plan also shows how buyers are trying to win tenants back with practical amenities and better shared spaces, not just cosmetic refreshes.

Even in a tougher cycle, buildings that feel easier to work in still have a path forward.

Catch you in the next issue,

Anne Morgan

Editor-in-Chief

Commercial Real Estate Weekly

P.S. Interested in sponsoring a future issue? Just reply to this email, and I’ll send packages!

How was today's edition?Rate this newsletter. |